Driving Adoption and Engagement: Building an Effective Incentive Market for Your Protocol

Romain Figuereo

Founding Knight

Post Date June 24, 2023

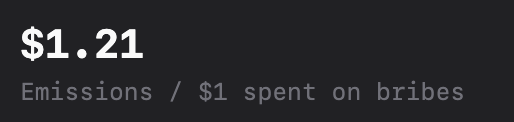

Vote incentives have become a large market processing over 100M$ of rewards per year. Originally introduced on top of the veCRV model by Andre Cronje, with the misnomer of “bribes”, this model enabled the sale of veCRV’s utility (gauge weight votes) and created a whole new stream of income for holders, strengthening the Curve ecosystem.

Since then, multiple projects have tried to replicate the magic formula by experimenting with vote incentives on top of their token utility. However, most have failed at generating an efficient market. This article was written in order to help builders looking to enable vote incentives on top of their protocol and is a summary of our two years of experience at Paladin in helping build vote marketplaces in DeFi.

So, let’s start with the basics: why would you want to create a bribe market?

Having a market for vote incentives enables an additional revenue stream for your stakeholders. Originally, this income is generated by the lending of your control over emissions. Do note, that as of today no protocol has been successful in creating a bribe market on a utility other than emissions. We believe it is theoretically possible to build it on top of any utility, provided its value is made extremely apparent to stakeholders.

The example of Curve, the pioneer

In Curve there is a delta between how much of the emissions you direct and benefit from, which is directly correlated to your dominance in the pools as an LP.

Of course, any such game cannot afford to be so straight-forward as it would become too gameable. As such, two mechanisms tame the value capture of emissions:

- Market-driven LP arbitrage, meaning if the APR of a pool becomes excessive, it is highly likely new LPs will come in to farm, effectively diluting the efficiency of the strategy;

- Boost throttling, the veBoost isn’t just a reward mechanism for LPs who locked their veCRV, it also enables non-aligned and / or overly dominant LPs to lose a bigger share of the emissions when new LPs come in the pool, effectively multiplying the efficiency of the market-driven arbitrage;

Understanding that these design choices were implemented to balance out the system will be key to your success in replicating such a flywheel.

What do you need in order to make this happen?

Here is an exhaustive list of mechanisms you need to implement before enabling a successful vote incentive market:

- Coveted value trickling from your governance token (emission allocation paired with deep liquidity, real-yield allocation, … etc);

- A balancing system to avoid excessive gamification (caps, thresholds or boosts)

- Delegation to enable vote market-making;

- Stakeholders ready to absorb the emissions in case of a high inflation system (Convex-like);

- A platform like Paladin to bring you bribers and stimulate demand for your flywheel;

At Paladin we have been working on a standardized of the veToken and vlToken frameworks in order to help projects adopt strong tokenomics while minimizing their work. If you are looking to kickstart a veToken flywheel feel free to contact us on Discord or at [email protected] to access the framework, share your plans or ask for an expansion of Quest on your protocol.