Paladin Mainnet Launch is Here

Alejandro Baquero-Lima

Community Knight

Post Date September 30, 2021

Time to get out of bed!

DeFi Madness

Depending on who you ask in the DeFi (decentralized finance) space, they will say that all the movement began in “DeFi Summer” in 2020 or they will say that it began in 2021. What we can all agree on is that the space has been extremely lucrative with some protocols offering APY returns of over 1000%. As the saying goes, “high risk, high reward”.

But with all the wealth created in the space, there have also been many issues that have arisen, namely governance. Many protocols have promised to become arbiters and protectors of decentralization. However, the reality is that they are not. In quite a few protocols, the majority of tokens are either held by the creators or the VC investors of the protocol. Generally, this was not done by design and there is more than one reason why protocols have ended up this way. One reason is a lack of activist voter participation. Enter: Paladin Protocol.

The goal of Paladin is simple: (To) “Turn your Defi vote into an asset”. What this means simply is that the goal of our protocol is to allow users to transform unused voting power (not votes) to build offensive and defensive positions in protocols the user cares about. In our launch, we have a main focus of creating more active user participation in voting proposals. This will in turn lead to better voter utilization.

No collateral needed

Another unique aspect of v1 of Paladin Protocol is that no collateral is needed. In short, tokens are never handed over to the borrower. Instead, borrowers pay a fee based on the amount of time the voting power is needed and are subsequently delegated the votes. This system makes sure the borrower’s capital is never exposed to any counter party risk.

It is important to note that our our protocol will never allow flash loans that have been known to damage other protocols.

Brief overview of how Paladin works on testnet and will work on mainnet.

Encouraging governance over yield

Oh no, another protocol

The above four words are words that you might have or had in your head while reading this article. Here’s the kicker though about our protocol: Instead of focusing just on yields and gathering speculators, we are developing tools to reward good governance. We want to and are working on mechanisms that will place governance rewards over yield rewards.

We will be conducting a “Knight of the Week” event that will be awarded to the most glorious member of our community on a weekly basis. The Squire who helped and participated the most in the community during the past week, one that has been a shining example of good governance, will be recognized and be given 100 DAI for their hard work.

The Summoning

Paladin Protocol will have yield available to earn on tokens but will be in Summoning phase the first two weeks. This deposit period might or might not be snapshotted to reward retroactive contribution to the rise of Paladin. More on this will be shared shortly after launch.

Future Roadmap

Just where are we going?

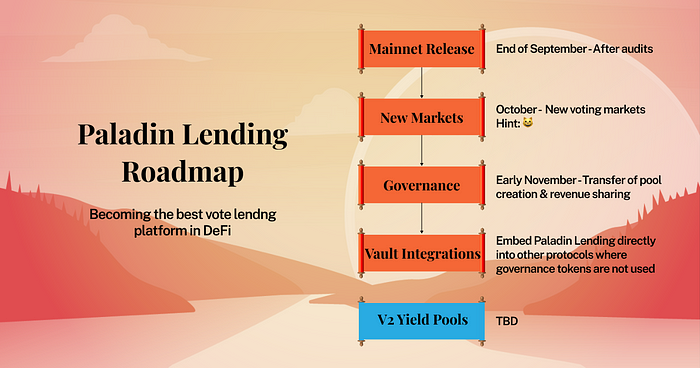

Roadmap for Paladin Protocol

Paladin Protocol has been a work in progress since January 2021 and we cannot be more excited to a launch and share it with you. In the future, we will also be adding new voting markets and enable transfer of pool creation and revenue sharing. After that is completed, we will enable integration of Paladin into other protocols where governance is not currently present.

Come join us and be part of our next quest and adventure!

Interested in finding out more? Check out our Discord here: http://discord.gg/SmgztXzYan

Source: “Decentralized governance in DeFi: Examples and pitfalls” Stroponiati et al. https://static1.squarespace.com/static/5966eb2ff7e0ab3d29b6b55d/t/5f989987fc086a1d8482ae70/1603837124500/defi_governance_paper.pdf