Paladin, the governance lending platform

Romain Figuereo

Founding Knight

Post Date June 05, 2021

In this heated bull market, many token holders are focused on yield and exposure to DeFi’s blue chips, seeing themselves more as speculators than shareholders.

We recognize it’ll take some time for all DeFi users to fall down the rabbit hole of community participation. We’ll do our part to convert more souls to the opportunities of DAOs, but in the meantime Paladin will provide yield to passive investors while making it easier for delegates and other members to contribute to the governance of financial commons.

In this article you will find a primer on why we built a governance lending platform, how Paladin 1.0 works and what it can bring to DeFi.

Vote usage is highly inefficient

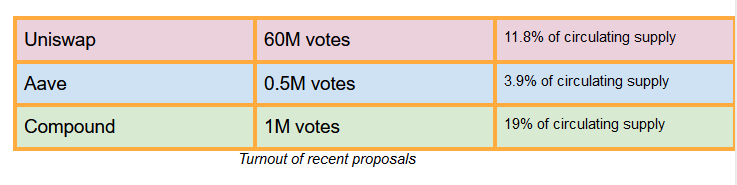

Have you ever wondered how active voters are in DeFi blue chips ? Let’s look at the numbers from some major protocols :

These are relatively low turnouts, even if you think in circulating supply (it’s much worse if you start thinking in fully diluted valuation).

We are still at the beginning of the adoption of financial commons, most protocols are still vesting an important part of their supply, but still an overwhelming majority of voters fail to participate in protocols which they co-own.

The fact that a bull market mostly attracts speculators over users with long term horizons most likely explains this severe voter apathy.

How can we fix this ?

Paladin as a liquidity reactor for governance

Paladin is a solution untangling motives and creating win-win situations for users.

Our goal with version 1.0 is to create more vibrant and active communities.

We tinkered a lot with this question and came up with an implementation of liquid governance : let the owner of the voting power decide whether he will vote, delegate or loan his voice.

Each choice offered has a different appeal and market. For now, we decided to focus on the most underdeveloped community, which is pure speculators. By creating a governance lending platform we are effectively allowing speculators to keep earning yield on tokens they hold, while creating another tool to empower activists in protocol management.

How it works

Paladin acts as a lending market that enables votes in DeFi to be financial assets.

Lenders can loan their governance tokens or any derivatives with voting rights (indexes, staked tokens, LP tokens) and create a new money lego for non-voters. For our Kovan test net you can mint loanable assets on the Kovan Aave Faucet.

Any delegate or protocol activist in need of topping off that last mile of votes to create a proposal can borrow the staked votes and leverage their influence inside a specific protocol.

The Paladin app will make it simple and effortless to manage voting positions, token yield and become the go-to tool for leveraging influence in DeFi governance.

A call to arms

With main net on the horizon we hope to see you join the cause and prepare for battle in our upcoming test net. This will mark your path in the Paladin journey and we’re excited to recognize brave allies.

Once we’re on main net, it will be up to you, as a community to help steward the cause, but in the meantime, we hope you’ll give us your support, join the Order and help spread the word.