Skinning the Bear like Paladin

Romain Figuereo

Founding Knight

Post Date September 12, 2022

In winter, everything freezes. Bear markets are the same, users disappear, the community is quieter, revenues melt.

With the exuberance of a bull market gone, a project's sustainability is put to the test, and we are reminded of the importance of basic survival skills that any traditional organization must master in order to survive (ie: risk & treasury management).

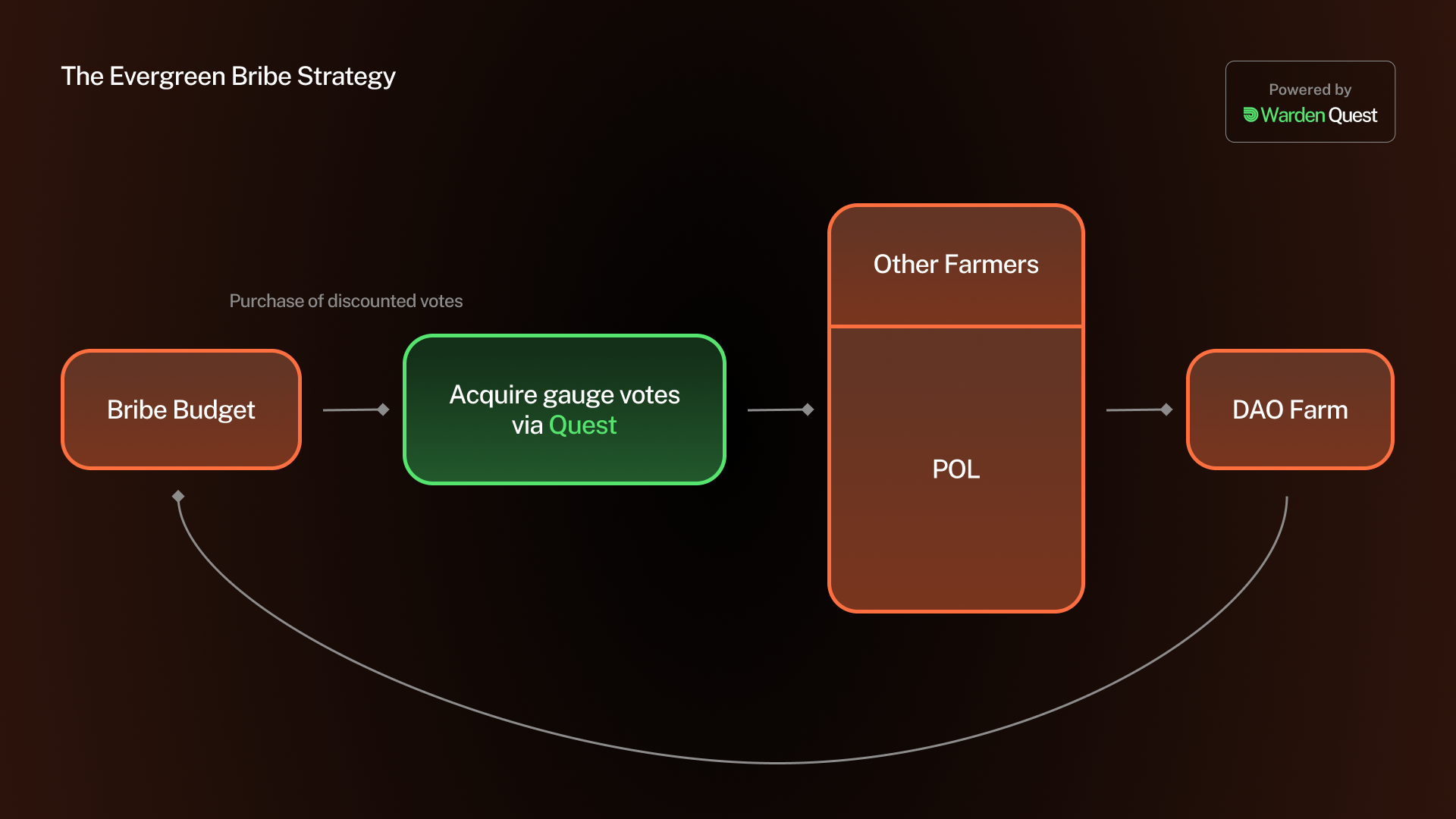

Paladin is not an exception to this. While our tech has proven its worth over the past few months, the true highlight of the summer was how Quest could be used to optimize treasury management for DAOs. The following strategy has allowed us to acquire significant revenue, not as protocol fee earners, but as protocol users.

Our focus on governance arbitrage has led us to the thriving Curve ecosystem where ~1500 stakeholders are participating weekly and bi-weekly to gauge weight vote. This process lets stakeholders decide where (more specifically in which part of the protocol) will the fixed weekly CRV emissions be allocated. Because these emissions can only be allocated to LP pools on Curve (with the exception of the veFunder), DAOs, whales and coordinated groups are the only ones truly benefiting from voting for a specific gauge. For them, directing yield to a pool can either be an optimal farming strategy, or a way to subsidize liquidity mining.

As a small farmer in a pool, you have no incentive in directing yield to other people. For this reason, there is an arbitrage between the actual value of a gauge weight vote (the emissions they control on a weekly basis) and how many small voters are ready to sell it. This phenomenon of incentivizing gauge weight votes is what we call bribes.

Most bribe marketplaces just let DAOs deposit an incentive, and the market prices the vote, depending on how many people participate. This very simple approach has proved to be successful, even though a substantial amount of DAOs actually pay more in incentives than they earn in emissions directed to the pool.

Quest was built to avoid this, by calculating beforehand the actual value of the vote, you can determine the ceiling price to ensure incentivizing gauge votes is actually cheaper than liquidity mining.

Another significant advantage of bribes is the fact that DAOs can incentivize with their own governance token, and emissions are done in CRV. This approach creates 3 major opportunities for DAOs:

1. Instead of distributing their tokens to mercenary farmers, they are giving them to capital allocators, and veToken holders, who tend to dump less;

2. Paying with your native governance token is significantly cheaper than paying in ETH/USDC;

3. A DAO owning their liquidity isn't incentivizing liquidity depth but actually earning revenue.

Let's focus on the last point as it is the crux of Paladin's current Quest strategy. As most DAOs, we believe owning our liquidity is cheaper than renting it. We own 100% of our liquidity on Uniswap, 80% of our liquidity on Balancer and 80% of our liquidity on Curve.

Because of this, when 1000 CRV are directed to our PAL-ETH pool on Curve, our DAO is theoretically farming 800 CRV. This means that if we're acquiring votes 20% under the value of the gauge weight vote, we are effectively buying CRV at a discount.

To generalize the logic, if 1$ of incentives enables over 1$ of emissions, you are effectively either buying the token at a discount versus the market price or, at least reducing your liquidity mining budget.

In a bit more than two months, we have acquired over 80,000 CRV this way, with close to zero risk of losing our initial capital during the process.

When creating a Quest, we look at the broader bribe market and identify a price that will attract voters (feel free to reach out for recommendations), determine how much yield we want in our pool and create a Quest with both parameters.

After that, we tweak according to two parameters, how many % of the pool we lost (yield attracts farmers) and the share of the pool between Curve and Convex staking.

Taking it to the next level by understanding boosts:

Curve has a boosting system that rewards farmers who have more veCRV locked. This boosting system is proportional to the total amount of the veCRV supply, which means you need all of the veCRV supply to max boost a pool you'd fully own.

Coming back to our original example, if 1000 CRVs are allocated to your gauge but you have no boost, you could farm as little as 40% of these CRVs. The trick is that Convex now owns over 50% of the whole CRV supply, so you should always deposit at least half of your LPs there.

If you want to go the extra mile and really optimize, you can also deposit 3.5% in the StakeDAO strategies, and borrow veBoost on Warden. We're currently deploying this strategy internally and hope to see a significant bump in revenue.

Transcend your treasury management with Quest:

As a parting thought, we don't want to show you again that Quest should be your go-to solution. Instead, let's talk about risk management.

In traditional businesses, any big budget is hedged to avoid things going haywire. Construction companies hedge against commodities, international companies hedge against currency volatility,etc... Protocols spending millions in gauge incentives do not hedge against participation.

What happens if someone outbids you? On Votium, you lose money. In Quest, you get fewer votes but get your budget back pro-rata of its efficiency.

Through conversations with DAO operators, we have understood that a lot of projects’ value actually getting the votes at least as much as getting the emissions at a discount. Multiple upgrades are in the works to amplify Quest’s reach. First, Quest is progressively becoming a multi-layer bribing marketplace, compatible with all wrappers of a veToken. Second, automated voting strategies are being built to attract more voters. Third, we are exploring options packaged with a Quest as a hedge against voting engagement. We can't wait to show you more about this.

In the meantime, come join us around the fire, bear market shivers are over with Paladin.