Tokenizing Influence in DeFi

Romain Figuereo

Founding Knight

Post Date March 31, 2022

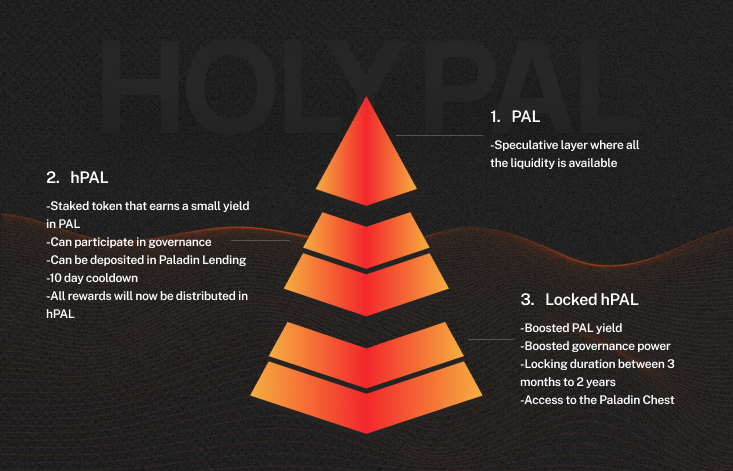

After months of development, we shared our vision of PAL tokenomics with the Paladin community for feedback, input and inspiration. We proposed a 3 tiered token structure built around Holy PAL (hPAL) that will enable long term incentive alignment between Paladin stakeholders, protocol growth, PAL utility and wider ecosystem impact in DeFi governance.

Here’s a quick primer:

While the global architecture was extremely well received, there were some confusions around the Paladin Chest module (currently in development). This novel design, pivotal to our tokenomics proposal, was underestimated, and/or misunderstood a lot.

This is on us, we failed to communicate clearly how powerful the mechanism could become. To fix this, this article will expand on our vision of the Paladin Chest.

There will also be a public tokenomics design session with the community in the Agora channel on our Discord server on April 11th, 2022 12:00 Eastern US, 18:00 CET to discuss its strengths and weaknesses so we can maximize its value for PAL lockers.

In the meantime here is our thought process in designing this mechanism.

Certainty is gold in the kingdom of apes

A token is a necessary step in the decentralization process as it allows to spread the decision-making process to all the stakeholders, making the protocol more resilient.

Our three tiered approach allows us to exponentially reward aligned stakeholders while giving the protocol more insights on the current alignment of its stakeholders. This will allow the DAO to tailor its monetary policy in accordance with this data.

Creating certainty, of liquidity, stability, participation, is one of the most valuable things we can create for the sustainability of Paladin.

But this doesn’t create feedback loops with the dapps. A token divorced from its ecosystem is a wasted opportunity.

How does hPAL strengthen its dapps

One of the most straightforward models of tokenomics is fee-sharing. You buy a token because you believe it is going to be a huge revenue generating protocol and you want to benefit from this new stream of wealth.

In our case we don’t believe such an approach is elegant enough for Paladin. Doing so would attract users with the promise of yield. But Paladin is not directly about money, it’s about power. The users with whom we want to align are governors, not speculators.

Instead of offering yield, we’ll offer influence.

By locking hPAL for over a year, stakeholders can re-use protocol revenues that are only accessible through the Paladin Chest. These funds are designed to be the ultimate weapon for protocol politicians. With them, holders can use our dapps at a discount or for free (depending on how much PAL they’ve locked and for how long). At release this will enable lockers to access DeFi voting power, CRV boosts, gauge weight and more.

If you’re interested in knowing more about the incentives and benefits, don’t miss the upcoming tokenomics design session posted above.

With the current Chest model we can create more volume for our dapps, exponentially reward governors vs speculators and facilitate the creation of coalitions via our tokenomics.

Coalitions?

From the release of the Chest, lockers will be able to delegate or sell their Chest rights. By enabling this market on top, you can create cash flows from other users who need a bigger allocation of the Chest’s total distribution. With this kind of flexibility, Holy PAL will become a hub for activist opportunities while still balancing passive holder’s interests.

Scaling governance with PAL activists

Let’s take a moment to see the bigger picture unfolding in the Paladin ecosystem.

The Chest mechanism wasn’t designed to just synergize the PAL token and our dapps, it was designed to become the foundation of an emerging participation economy. Paladin is officially going to start working on what we called Phase 2, and strive to become a governor-centric ecosystem.

Governance will continue to be sustainably gamified, and we’ll fund initiatives both internal and external to be at the forefront of its development. We’ll also expand the revenue base of the protocol through new dapps and projects, growing the opportunities on the locked layer.

More generally, this system was built to make governance fun. This dynamism will enable us to gamify governance. We think governance is a fun and fascinating endeavor, and we hope to share our interest with as many people as possible. Who wouldn’t be interested in games of power controlling billions of dollars ?

Bullish on Paladin after reading this ? So are we.

See you soon,

Paladin core (🛡️,🛡️)