Voting Markets: Why now

Tom Amiri

Product Knight

Post Date July 16, 2021

DAOs have come a long way with countless projects coordinating through on-chain voting systems. At the heart of these is the 1 token: 1 vote standard. The distribution of these tokens typically goes to those with the most capital, a concern for many who want to maximize decentralization in the long run. The problem with tweaking voting parameters is that there can be so many technical security and regulatory implications.

That’s why we think the time is ripe to explore a new kind of vote borrowing.

To be clear, Paladin isn’t creating vote borrowing. Today anyone can deposit collateral into one of DeFi’s many lending protocols and borrow the governance tokens they want. It’s already happening, but we believe there’s a better approach.

In this post we’ll explore how an open voting market can improve decentralization, boost transparency and make tokens more productive assets.

Accelerating stakeholder inclusion

Protocol’s are still early in their “progressive decentralization” journeys. That means governance power is heavily concentrated at the moment between a few large stakeholders (core teams, investors, early whales).

There’s a push for greater delegation, but there could be issues with relying on delegation. Yes representatives have to earn trust and campaign for votes, but they hold no obligations to their voters. There are no safeguards for removing power from a delegate if their base is passive or apathetic (what if their approval plummets but their voters don’t un-delegate their votes due to inertia?). This is where a voting market could avoid the accumulation of power in the form of governance liquidity.

With participation rates so low, there’s enough passive tokenholders to form a sizable counterweight to the biggest stakeholders. In this case, the concentration of power is good because core teams can safely veto proposals. Hence why we think this is the best time to try.

Transparency

There’s little to no friction in offering large tokenholders OTC offers for their voting influence. Delegates can receive huge sums of delegated votes randomly. If people were doing deals on a market dedicated to voting power then the data around these behaviours would be a lot cleaner. It would create a feed for governance activity to give builders and users a better sense of what is happening within a protocol. We’d also get a better sense of how many passive investors want exposure to governance tokens.

There’s been recent controversy with TUSD and COMP governance. A wallet believed to be owned by Justin Sun has positioned itself to amass a big chunk of COMP incentives. While it leveraged borrowed COMP to vote on proposals, there’d be less ambiguity about this person’s strategy if there was a voting market. Communities can respond better when they understand stakeholder’s interests around influence.

Productive Assets

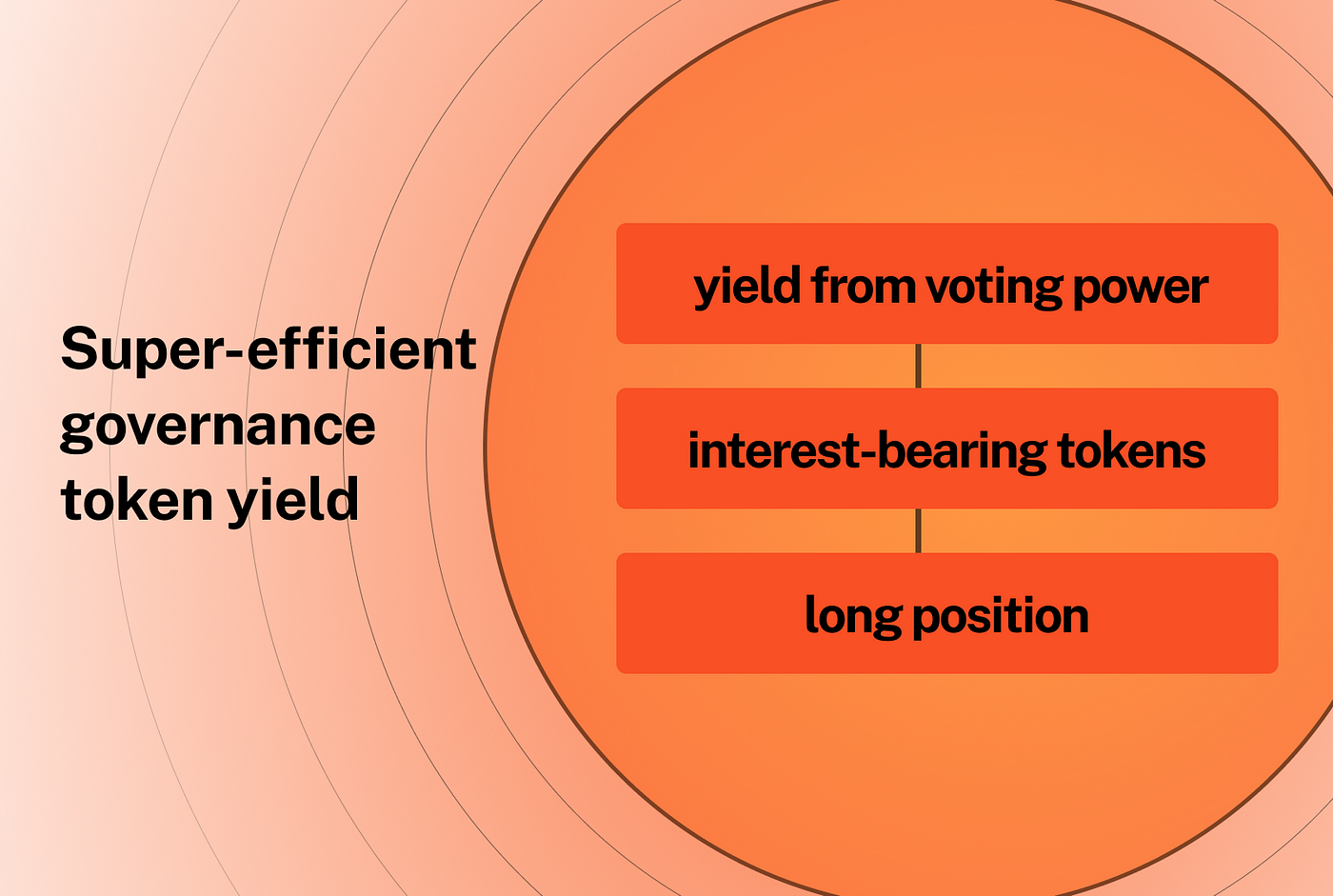

If a voting market existed there would be more opportunity costs caused by leaving governance tokens unutilized. An idle asset doesn’t generate any yield and also wastes the voting power that could have had a positive effect on the protocol. By contributing to the voting market, people who don’t want the overhead of governance can enable those who do care. This dynamic can even be supercharged when voting rights are enabled in interest-bearing tokens. Paladin would become the top layer of a money lego stack.

Some final thoughts

With influence becoming more liquid, the market can transform into a better medium for protocol engagement. While existing core members maintain safeguards, more stakeholders can become involved in meaningful contests over the operation and direction of the protocol. Vote borrowing can be a better signal for player’s convictions as long as there is a market for them to act. In high conviction contexts players can campaign for their beliefs and utilize every resource available.

An important point to note about all this is that voting markets only work when most tokenholders are disengaged. When participation reaches higher levels this market will fade, while having served as an important stepping stone in the evolution of the ecosystem by activating passive token holders. In the meantime we can experiment with DeFi governance and consolidate what works into the decision making layer of permissionless finance.